Virginia Paycheck Calculator

Your Paycheck Breakdown

Virginia Paycheck Calculator – Estimate Your Take-Home Pay Accurately

Managing finances starts with knowing how much money you actually take home after deductions. Whether you’re an employee or employer in Virginia. A Virginia Paycheck Calculator is essential for estimating your net pay. It calculates taxes, deductions, and final earnings, ensuring you have a clear picture of your finances.

What is a Virginia Paycheck Calculator?

A Virginia Paycheck Calculator is an online tool designed to help workers determine their earnings after taxes and deductions. It considers federal, state, and local taxes, along with benefits, retirement contributions, and more. Whether you need a paycheck calculator Virginia for salary or hourly wages, this tool simplifies payroll calculations.

- Gross Pay: Input the employee’s gross earnings, which could be hourly or salary-based.

- Deductions: The calculator considers various deductions, including federal and Virginia state taxes, Social Security, Medicare, and any other optional deductions like retirement contributions, healthcare, etc.

- Net Pay: It provides the net amount that the employee will receive after all deductions.

2. Estimate Tax Withholdings

- The tool calculates federal income tax based on the employee’s tax bracket and filing status (single, married, etc.).

- It also includes state income tax calculations specific to Virginia, as each state has its own tax rates and brackets.

3. Help with Financial Planning

- Employees can use the paycheck calculator virginia to estimate their earnings and budget their finances, including planning for savings, expenses, and taxes.

4. Check Employer Contributions

- It can also calculate employer contributions such as unemployment insurance, worker’s compensation, or healthcare contributions in some cases, providing a more comprehensive understanding of employment costs.

5. Compliance and Payroll Management

- For businesses, it ensures accurate payroll management, helping them stay compliant with federal and Virginia tax laws, reducing errors in paycheck disbursement.

How Does a Virginia Salary Calculator Work?

A Virginia Salary Calculator helps determine your gross and net pay by factoring in:

- Federal tax withholdings

- Virginia state income tax

- Social Security and Medicare taxes

- Retirement and insurance contributions

- Other deductions

If you are paid by the hour, the Virginia Paycheck Calculator Hourly option helps estimate take-home pay for different wage rates and working hours.

1. Precise Take-Home Pay Estimation :- It makes the person know what actually will take home through the different deductions such as federal and state taxes, Social Security, Medicare, and many more. This is essential to budget, manage personal finances, and prevent shockers on payday.

2. Simplifies Complex Tax Calculations :- Of course, payroll and tax deductions are complicated enough without each state’s unique laws-think Virginia. The calculator automatically makes those complicated calculations, so federal and state tax withholdings are estimated just right, including allowances for dependents, filing status, and pre-tax deductions, such as 401k.

3. Helps Employees Plan Better:- It thus helps employees to have a very clear understanding of their net income to plan for costs, savings, and investments. They are also able to adjust their tax withholdings if needed in order not to face huge tax bills or returns at tax time.

4. Helps Employers to Manage Payroll:- Employers utilize paycheck calculators to avoid mistakes in their payroll. Paycheck calculator virginia help an employer comply with federal and Virginia tax laws; if payroll errors occur, there is a possibility of being penalized.

5. Assists in Job Offer Choices:- A job applicant may use a virginia paycheck calculator in comparing salary offers. The difference in the amount of net income left over after taxes and withholdings from two different salaries is usually very representative of the real value of one’s salary offer.

6. It avoids Over- or Under-Withholding :- The calculator avoids over withholding or under withholding of taxes. Employees can fine-tune their W-4 forms based on the result, making sure that their withholding is neither too much nor too little and, hence, avoiding the issues at tax time.

7. It can be Customized according to Benefits and Deductions :- You can add various types of deductions such as health, pension or retirement payments etc which affect the actual salary one gets. This personalization helps in enlightening the staff member as to what actually these benefits do to his total remuneration.

8. Saves Time:- Instead of calculating all the modes of deduction, the va paycheck calculator does this task more efficiently and returns the correct result faster, thus becoming one of the favorite tools for both employees as well as employers.

With a paycheck calculator, any individual looking to know better the amount of take-home pay remaining after deducting taxes will find a very resourceful tool. For a Virginia resident, using a paycheck calculator determines the amount of gross income that will remain after state and federal taxes and all other withholdings are applied. Perhaps you are getting an error through your computer search for “Virginia paycheck calculator, va paycheck calculator 2024 or Virginia paycheck tax calculator.” You probably need such a calculator to make these calculations easier. Below is a brief guide on how to use these calculators and the types of results you can expect.

Payroll Calculator VA: What Employers Need to Know

A paycheck calculator for Virginia will help you estimate your take-home income, remembering to take into account state tax, federal tax, Social Security, Medicare, and insurance premiums. Just enter your gross income and any other information about your deductions, and you will get a detailed breakdown of exactly how much your gross income will translate into. Useful whether you are paid on an hourly basis or have a salary.

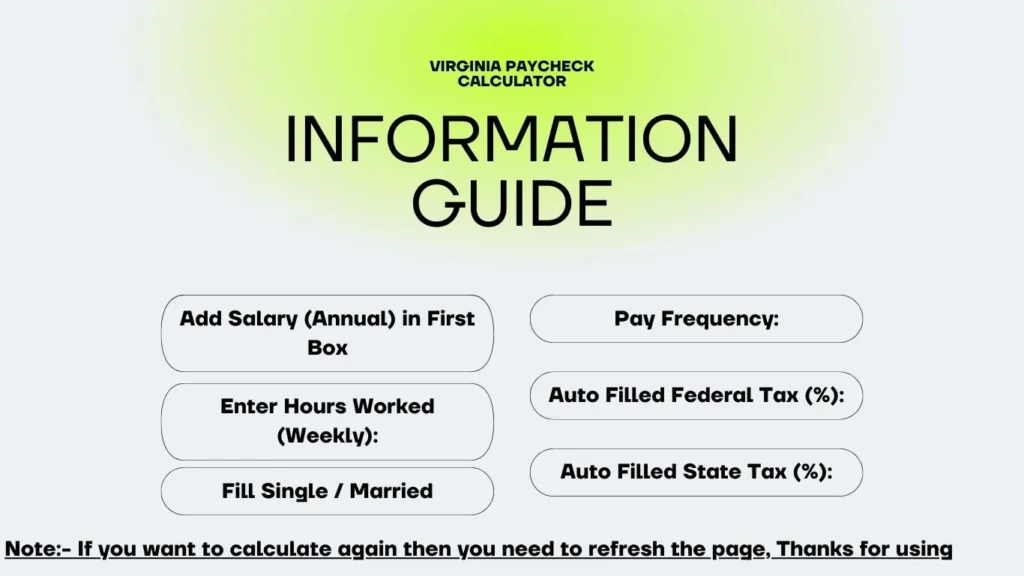

Here are a few steps to follow when using a paycheck calculator in Virginia:

- Enter Your Gross Pay: Start by inputting your total earnings before any deductions. This could be based on an annual salary, monthly wages, or hourly earnings.

- Add Payroll Details: If you have additional income, bonuses, or commissions, enter these values.

- Select Pay Frequency: Specify how often you get paid—weekly, bi-weekly, semi-monthly, or monthly.

- Include Pre-Tax and Post-Tax Deductions: These could include retirement contributions, health insurance premiums, or other deductions.

- Review State and Federal Taxes: The calculator will automatically take into account federal tax rates and Virginia’s state tax regulations.

- Calculate Your Paycheck: Once you’ve filled in all the required information, the calculator will estimate your take-home pay.

Types of Va Paycheck Calculator – Virginia

- Virginia Paycheck Calculator Hourly / Virginia Hourly Paycheck Calculator: If you are paid by the hour, these calculators are ideal for calculating your take-home pay. By entering your hourly wage, hours worked per week, and pay frequency, you can easily determine your net income.

- ADP Paycheck Calculator Virginia / ADP Virginia Paycheck Calculator for Virginia Users: ADP offers va paycheck calculators specifically designed for Virginia users, allowing you to factor in state-specific tax rates. This tool is widely used by employers and employees to ensure accurate payroll processing.

- Paycheck Tax Calculator Virginia / Virginia Tax Paycheck Calculator: This type of calculator focuses on determining the amount of tax that will be withheld from your paycheck, helping you understand your tax liability.

- Paycheck After Taxes Calculator Virginia: For those who want to know their take-home pay after all deductions and taxes have been applied, this calculator provides a comprehensive breakdown.

- Virginia Paycheck Calculator 2024: If you’re looking to understand paycheck calculations for the current year, ensure that the calculator is updated with the latest tax rates for 2024.

Virginia and West Virginia Paycheck Calculators

Sometimes the calculations of pay can be very intricate, as it depends on what state or local tax laws are involved. Here is a breakdown of paycheck calculators for both Virginia and West Virginia, along with particular tools for either hourly, salaried, and overtime calculations. I will provide key features for each to guide you toward the right tool for your payroll.

Virginia Paycheck Calculator

Using the Virginia paycheck calculator, state employees and employers can know their take-home pay promptly. Simply input your salary, deductions, and any extra contributions, and you’ll have an accurate measurement of how much your take-home pay after taxes will be. The calculator is thus helpful in the planning of your budget as you know precisely how much money you’ll be carrying home after the Virginia taxes have been deducted.

West Virginia Paycheck Calculator

West Virginia has its own payroll taxes, so a West Virginia Paycheck tax calculator would be a great tool for Mountain State residents. The calculator takes into account state-specific deductions such as federal and state tax withholdings to accurately estimate net pay. This is a very efficient tool for any individual who requires clarity about post-tax income in West Virginia.

VA Paycheck Calculator

The VA paycheck calculator is designed for Virginia’s workforce, which can calculate pay after deducting federal and state taxes. The calculator is easy to use and can be customized according to various types of deductions. Taking into consideration the income tax rates of Virginia, this calculator makes payroll easy and provides the workforce with an accurate estimation of net pay.

Hourly Paycheck Calculator

For hourly employees, an hour paycheck calculator is a must-have. You input your hour wage, hours worked, and any deductions, and you get an approximate figure for your earnings. This versatile tool supports the calculation of employees who work variable hours or overtime so that pay records are correct.

Paycheck Calculator Virginia

This paycheck calculator is specialized to the Virginia state. Be it pay per salary or pay based on an hour, clear insight regarding gross versus net pay comes about through calculations made about Virginia state deductions.

This paycheck tax calculator, especially from Virginia, will assist the employee in devising budgets and knowing about his or her take-home pay.

The Virginia paycheck tax calculator is a must for residents who want to know about their withholdings. Calculations of deductions are carried out according to the prevailing tax rates in Virginia. This will include federal withholdings. The tool helps users understand how much goes to taxes and what net income remains.

West Virginia Paycheck Calculator / salary calculator virginia also

For those who live near state borders or work in neighboring areas, it might be helpful to also use a paycheck calculator for West Virginia. Here are some options:

- Paycheck Calculator West Virginia / West Virginia Paycheck Calculator: These calculators are similar in function to Virginia’s calculators but account for West Virginia state tax rates.

- Paycheck Calculator Near West Virginia: If you live near the border, this calculator helps estimate take-home pay when factoring in cross-state employment.

- Virginia Salary Calculator: A Virginia salary calculator is a very reliable source that can give any one an understanding of the potential earning capabilities in the state.

The Payroll Calculator VA is the online application that gives you gross pay, net pay, and extra information for payroll in Virginia using an efficient calculation of specifics- your hourly rate, overtime hours worked, deduction, and tax withholdings. This way, it will help you know how much you have earned and what is taken out of your paycheck, and these will be easily cared for.

FAQ

What is a VA Paycheck Calculator?

A VA Paycheck Calculator is a free tool that gives you a pretty good idea of what kind of take-home pay you should expect after taxes and deductions have been taken out. They give you a good feel for what your earnings potential might be.

How Does a VA Paycheck Calculator Work?

You input, such as your gross income, tax filing status, and number of allowances. From there, it estimates for you federal, state, and local taxes as well as other deductions like Social Security and Medicare.

How would a Virginia Paycheck Calculator help you?

A Virginia Paycheck Calculator is a quick net pay or take-home pay estimate in relation to the factors outlined above. You will find that such a tool helps you do the following:

Budget finances much better.

Understand how changes in your income or deductions will affect you.

Make conscious financial decisions.